January 23, 2026

Important scheduling update from City Hall! Beginning Monday, February 2, City Hall will be closed daily from 12:00–12:30 PM for lunch. Normal business hours will resume promptly ...

January 20, 2026

This week we are spotlighting Pendleton Candy Company! From the moment the doors opened on November 1, 2025, this little sweet shop has been finding its place in the heart of Lib...

January 10, 2026

We are so excited to officially share our brand-new logo, created to celebrate a huge milestone for the City of Liberty’s 150th birthday. This logo represents more than just an ...

January 10, 2026

To celebrate the City of Liberty’s 150th birthday, the City of Liberty invites community members of all ages and skill levels to participate in a special art exhibition titled “Wh...

January 6, 2026

We're kicking off "Talk of the Town" this week with: The Nail Loft In February 2025, a new beauty space opened its doors in Liberty. The Nail Loft was built with intention, crea...

November 13, 2025

These boards play an important role in guiding the City’s growth and development. If you are interested in serving your community and helping shape Liberty’s future, we encourage ...

November 10, 2025

The Liberty Police Department would like to announce its annual “Shop with a Cop and Other Heroes” event. This is an opportunity to work with families in our surrounding community...

October 28, 2025

Due to recent transitions within the Chamber of Commerce, City Hall will be coordinating this Saturday’s ribbon cutting ceremonies. While this is not something typically handled b...

October 2, 2025

As Pickens County property owners are aware, the County prepared and issued County-wide reassessment notices on or about September 16, 2025. The county municipalities do not parti...

September 22, 2025

Sign up today to participate in the Holly Jolly Christmas Parade! https://forms.gle/muFeUeQiAYfzcrAT9 This year’s parade will take place on Saturday, November 29th at 6pm, wit...

September 22, 2025

Brush collection includes logs, branches, and sticks that are no longer than 8 feet. Leaves and clippings must be bagged, and bags of any color are acceptable.For bulk item pick...

September 10, 2025

The City of Liberty is currently accepting applications for two open positions: Economic Development and Events Coordinator (previously advertised as Administrative Coordinator)...

August 21, 2025

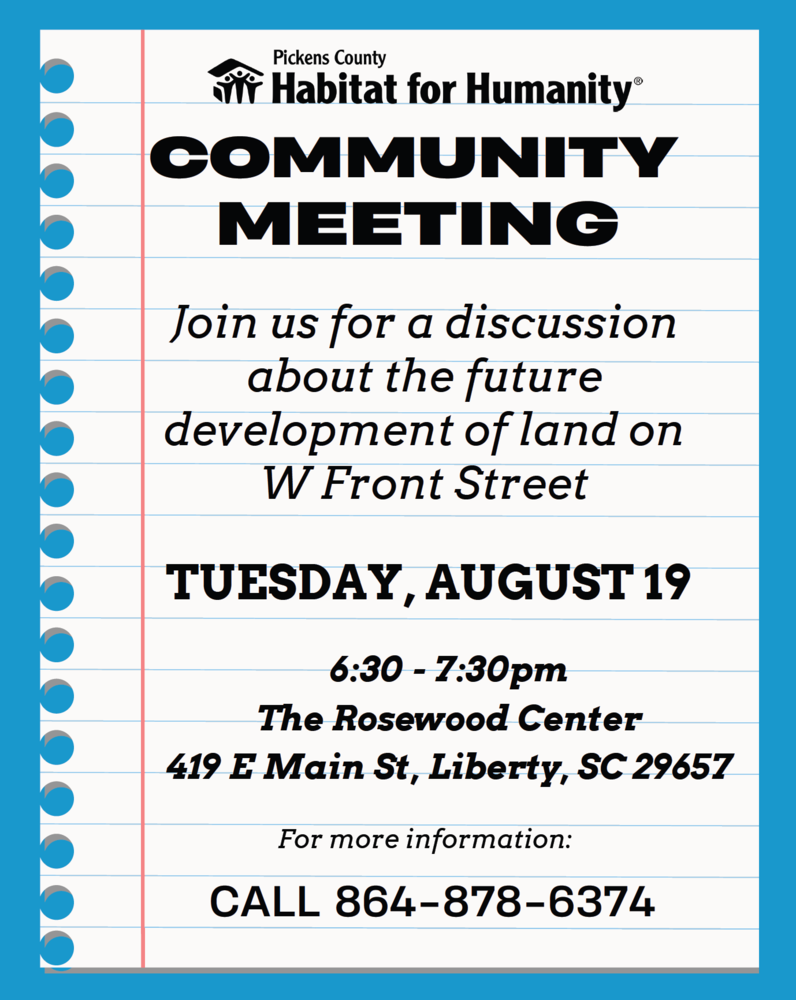

Background Info on the Donation/Habitat’s Mission: In December of 2024 Habitat received a gift of approximately 2 acres on West Front Street in Liberty from the Crotwell fa...

August 21, 2025

Signing up does not commit you to any specific event. Our events team will reach out before each event we need help with and check to see if you are available. If you are interes...

August 13, 2025

Hosted by Pickens County Habitat for Humanity. This session will introduce the public to Pickens County Habitat for Humanity and share details on their recent acquisition of a 2-...

August 8, 2025

What's up Rec Devil Nation! You asked... We delivered. Liberty Rec fan gear shipped right to your door! The best news?! 10% of proceeds go directly back into the Liberty Rec. W...

August 5, 2025

This week, coaches with the Liberty Rec will begin rolling out a new program called "Champions of Character." This program was created by the Liberty Rec, for the Liberty Rec -- a...

August 5, 2025

October 31 – Trick-or-Treat on Commerce Street + Fall Festival at Sarlin Park This year, we’re teaming up with Potters Clay Fellowship to bring even more fun to Halloween night!...

August 4, 2025

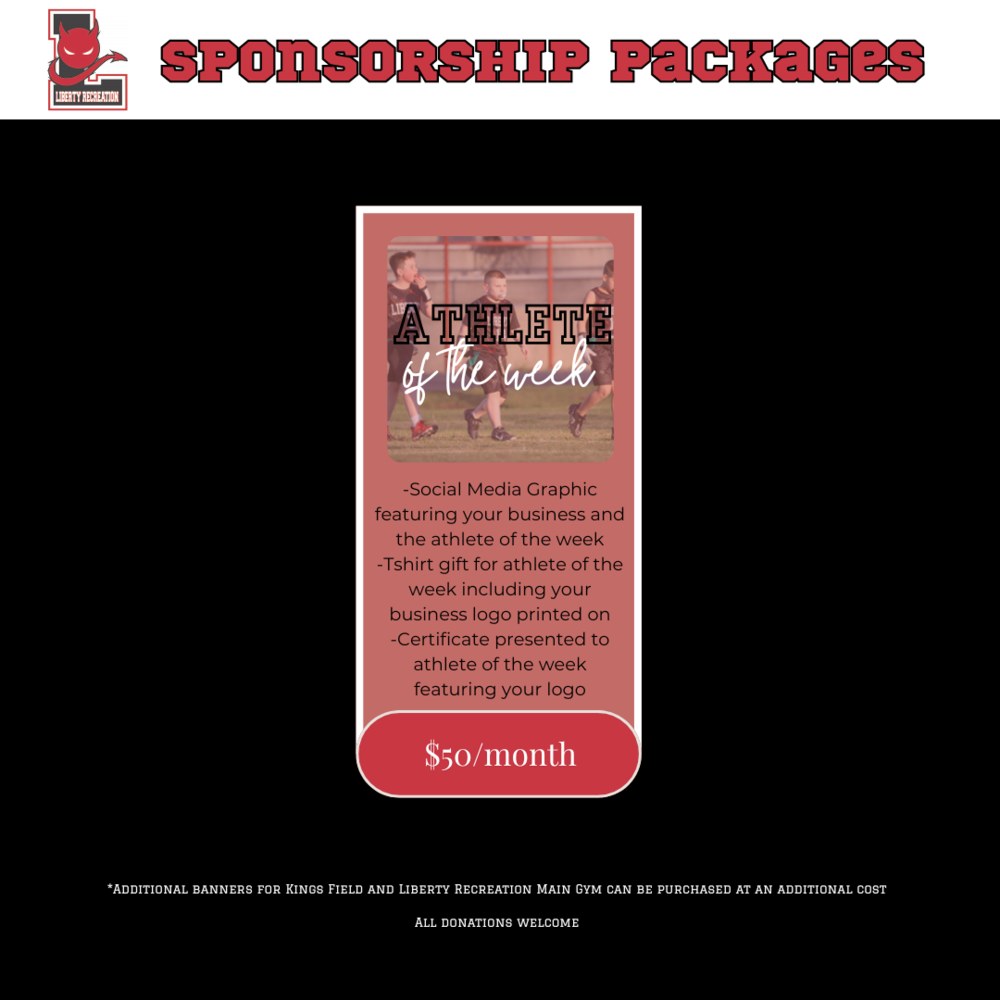

The City of Liberty Parks and Recreation Department is currently looking for Businesses to sponsor our new Athlete of the Week program .

August 1, 2025

A Message to the Community from the City of Liberty We’ve received an influx of emails, phone calls, and in-person questions this week about business licenses, and we want to tak...